salt tax deduction california

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. Read customer reviews best sellers.

Congress And The Salt Deduction The Cpa Journal

Rosenthal JD and Krista Schipp CPA.

. California does not allow. 1 The cap on SALT deductions applies for tax. California Governor Gavin Newsom signed.

Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

How long is the SALT deduction in effect. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. For your 2021 taxes which youll file in 2022 you can only itemize when your.

California is poised to restore corporate tax breaks and extend the states workaround for the federal cap on deductions for state and local taxes. Since the passing of the TCJA you can only deduct 10000 effectively losing a deduction 12000. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted.

The California SALT deduction workaround passed July 16th 2021 with the California Budget and will be effective from 2021 to 2025. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

State and local taxes. As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle Sam. Californias average SALT bill is the third-highest in the US.

Ad Browse discover thousands of unique brands. But you must itemize in order to deduct state and local taxes on your federal income tax return. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. This is due to the states. In the negotiations over the Tax Cut and Jobs Act enacted in 2017 Republicans saw the cap on deductions as a way both to save costs and also to penalize states such as.

In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the. Adding the 10000 cap increases the payment of an average.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Second the 2017 law capped the SALT deduction at 10000 5000 if. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

By Corey L. California Governor Gavin Newsom signed Assembly Bill 150 on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass. The TCJA added in IRC Section 164b6 effectively placing a 10000 cap on taxpayers federal itemized SALT deductions.

The federal tax reform law passed on Dec. The Tax Cuts and Jobs Act. High income tax rate.

While AB-150s elective tax work-around appears quite favorable to California residents the devil is always in the details which we address below.

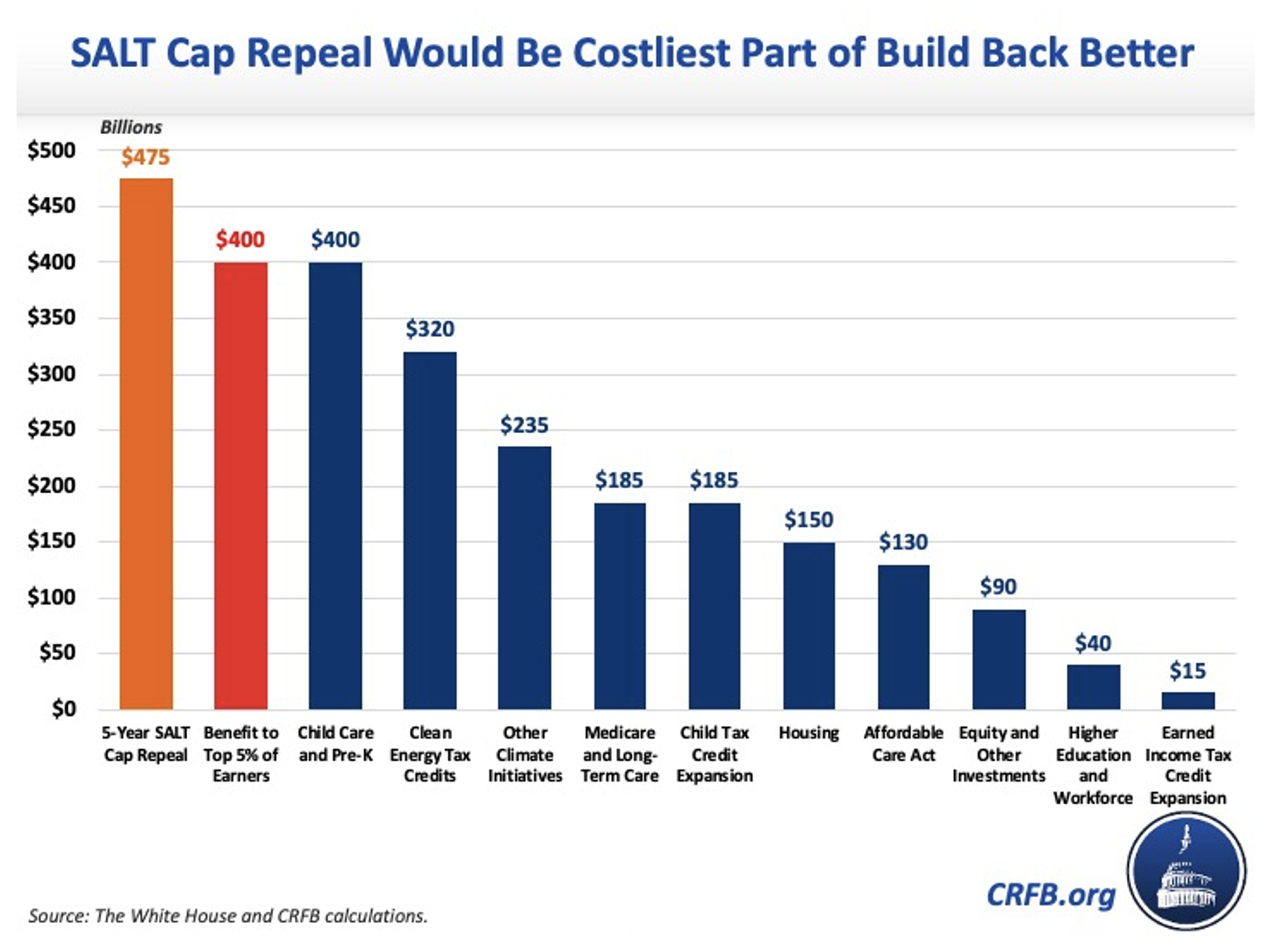

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

Take Claims About State And Local Tax Deductions With A Grain Of Salt The New York Times

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

California Makes Favorable Changes To The Pass Through Entity Tax Kbf Cpas

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

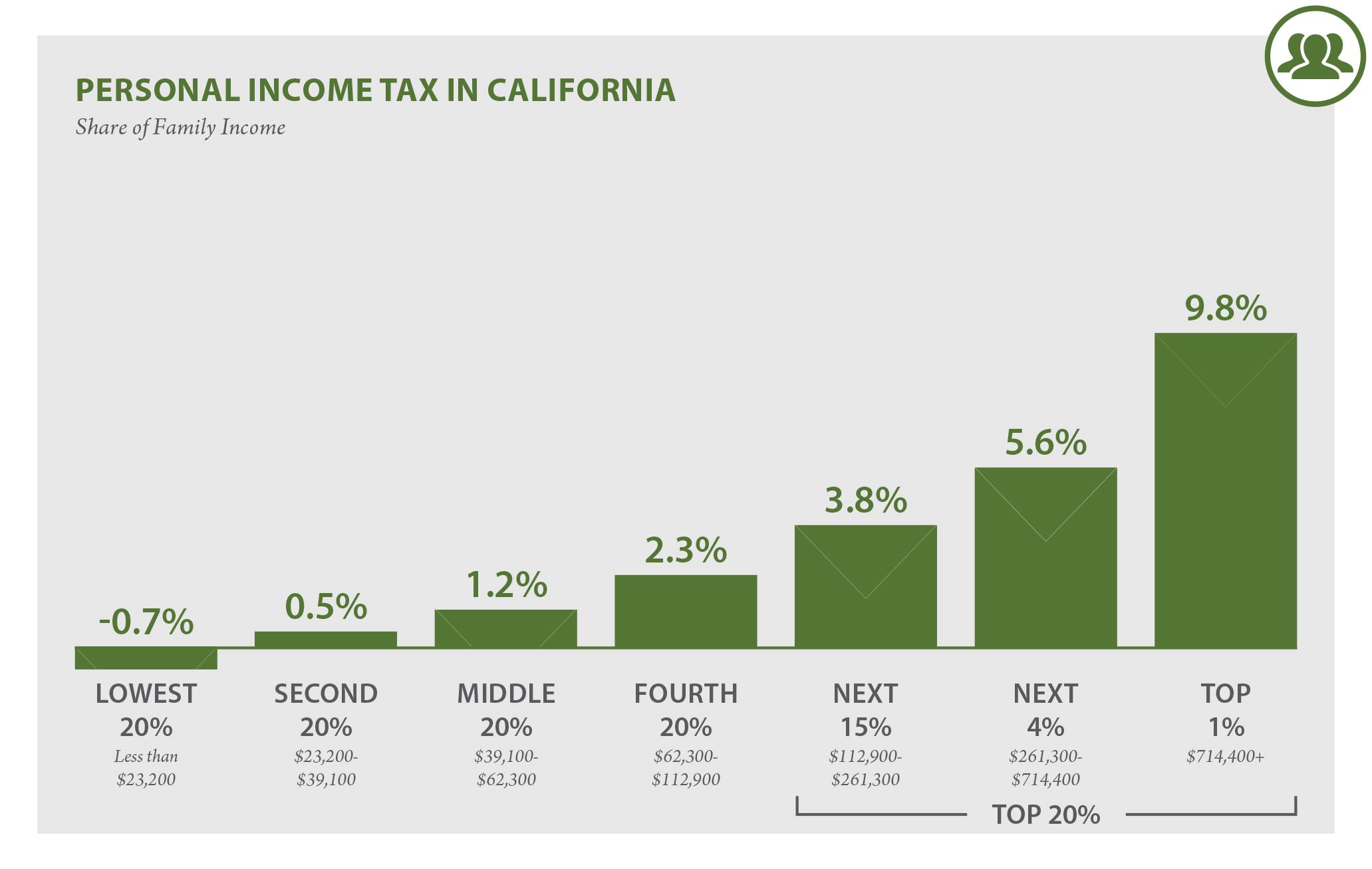

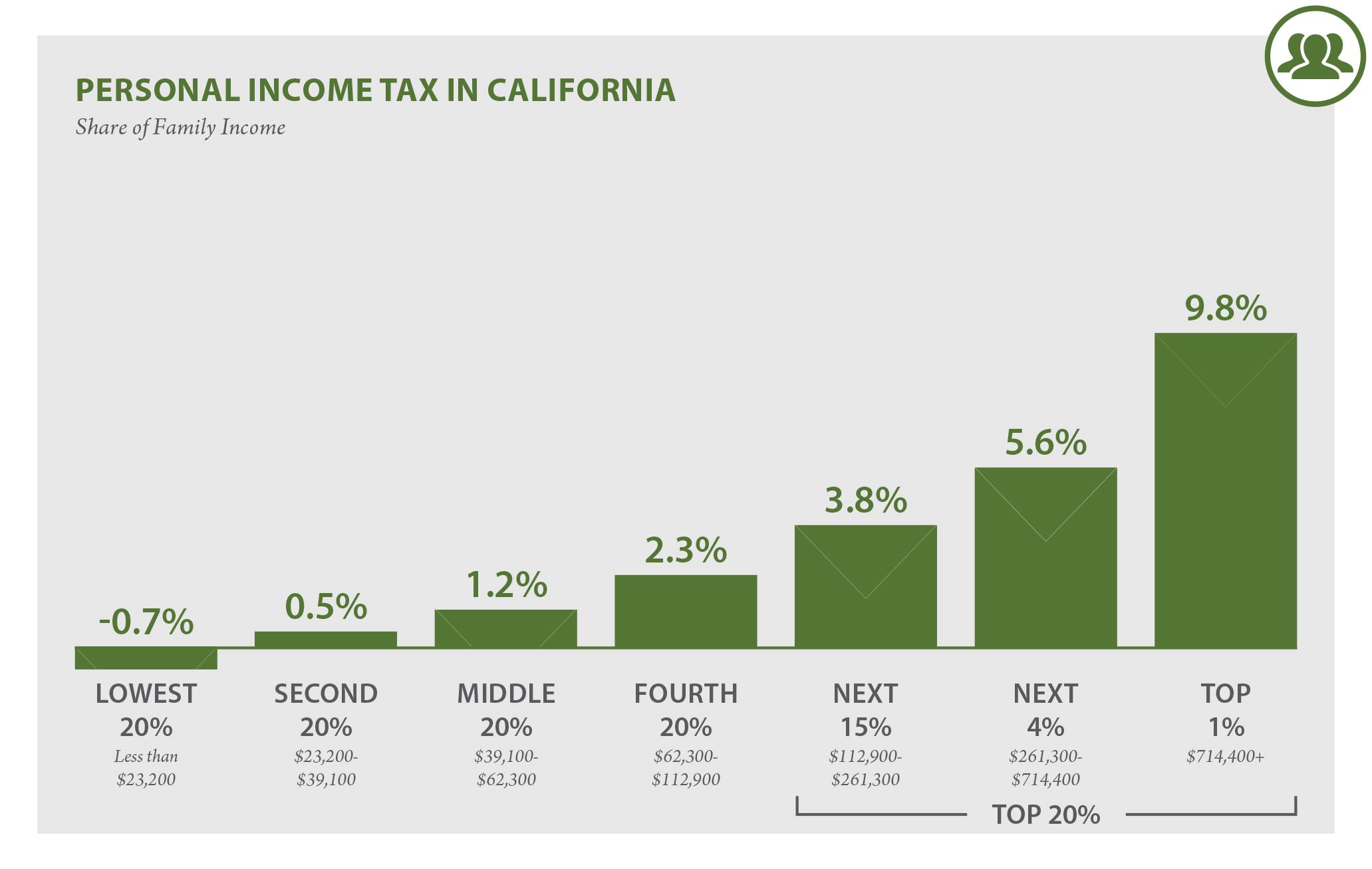

California Who Pays 6th Edition Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

State And Local Tax Deductions Implications For Reform Aaf

What Is The Salt Deduction H R Block

Salt Deduction For Passthrough Businesses Webinar Replay Explainer Video For Ab 150

Assemblyman Kevin Kiley I Am Introducing Legislation To Restore The Full Benefit Of The Salt Deduction For California Taxpayers Governor Brown And Senator De Leon Have Lamented That Eliminating Salt Subjects

California Expands Salt Workaround And Repeals Nol And Business Credit Limits Weaver

Skelton It S Time To Lift The Cap On Salt Deductions Los Angeles Times

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget